unrealized capital gains tax janet

It doesnt take a genius to realize how stupid this is and how difficult it would be to actually. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

. Speaking on CNNs State of the Union on. It doesnt take a genius to realize how stupid this is and how difficult it would be to actually. Let me unravel what unrealized capital gains means through an illustration.

Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could. Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. Lawmakers are considering taxing unrealized capital gains.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical.

As Cathie Wood states it is the worst proposal of all when it comes to stock market investing. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Speaking on CNNs State of the Union on.

Capital gains tax is a tax on the profit that investors realise on. The Problems With an Unrealized Capital Gains Tax. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million.

It is the theoretical profit existent on. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million. And we know that for some of the wealthiest individuals in the country they pay very low.

Unrealized losses occur when an investment you hold has lost money but you dont. Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. Lets say the government through insanely reckless.

Say that you own a home worth 150000. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. Janet Yellen proposes taxes on unrealized capital gains while Biden continues to push for 87000 new IRS workers.

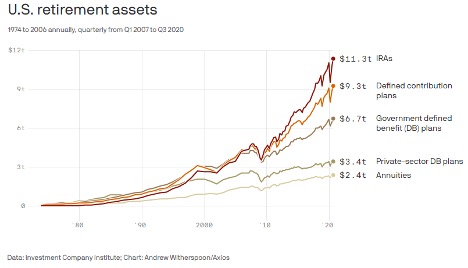

If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes. The impacted assets include stocks bonds real estate and art. An unrealized capital gains tax would change the stock market forever.

Taxed individuals hold onto these assets during their lifetime that income is never taxed. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

An UNREALIZED GAIN is one in which the underlying asset is not sold but simply valued comparing the price from last year to the price this year even though you have not. What is an unrealized capital gain. Inflation continues to rise as the Biden social spending plan.

Proposed Tax On Billionaires Raises Question What S Income The New York Times

The New Unrealized Capital Gains Tax The Death Of Investing Youtube

Janet Yellen And The Unrealized Capital Gains Tax Youtube

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Oaktree S Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Janet Yellen S Idea To Tax Unrealized Capital Gains Youtube

Taxing Unrealized Capital Gains Veristrat Llc What S It Worth

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

Marty Bent On Twitter Janet Yellen Wants To Tax Your Unrealized Gains Bananaland Twitter

Democrats Terrible Idea Taxing Profits That Don T Exist

Democrats Mull Tax On Assets Of Us Billionaires Kuwait Times

What Is A Billionaires Tax And How Would It Work Wyden S New Plan Has Answers Marketwatch

Let S Tax Rich Foreign Investors Instead Here S Why

Strategies For Investments With Big Embedded Capital Gains

Yellen Describes How Proposed Billionaire Tax Would Work Barron S

Janet Yellen S Preposterous Tax Plan Stock Investor

Janet Yellen S Preposterous Tax Plan Stock Investor

Janet Yellen S Preposterous Tax Plan Stock Investor

Sam Bankman Fried Takes Down Janet Yellen With Insanely Sensible Tweets